The Secret Behind Market Depth: How Professional Market Makers Help Projects Avoid Exchange Delisting

Maintaining a healthy market depth is one of the most underestimated challenges that crypto projects face after listing on an exchange. Teams often assume that once they are listed, liquidity will grow naturally — but in reality, most tokens struggle to meet exchange liquidity requirements , face unstable order books, or deal with volatility caused by shallow markets.

In this article, we explore why market depth matters, how poor liquidity threatens a project’s reputation and listing status, and the role specialized market-making teams play in stabilizing token performance. The insights here come from real challenges we have seen in the industry and solutions implemented by our team at Auradept.

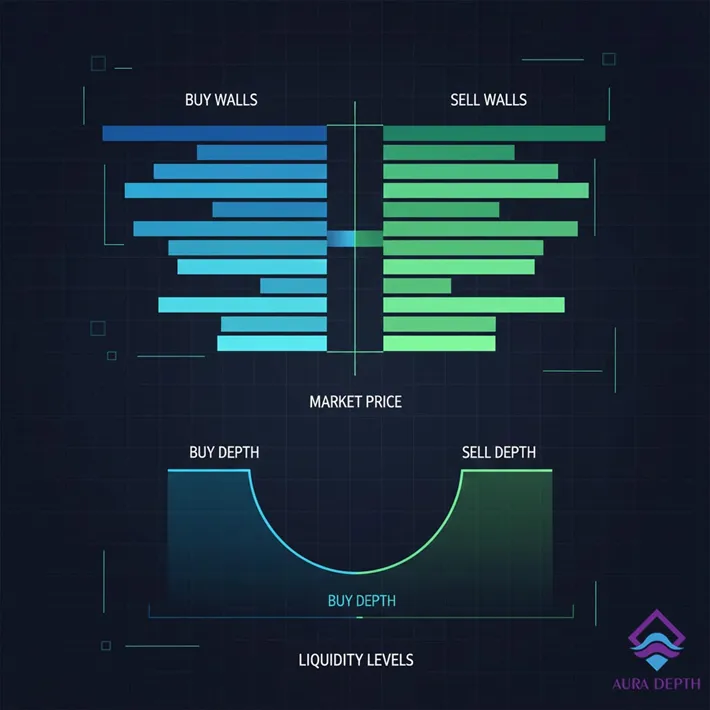

Why Market Depth Is the Hidden Lifeline of Every Token

Market depth is more than a technical concept — it is the foundation that ensures traders can buy or sell without causing sharp price swings. Exchanges like Binance, OKX, MEXC, and KuCoin have strict market-depth and liquidity standards, and failing to meet them can trigger:

- Delisting warnings

- Reduced visibility in trading sections

- Lowered trust from investors

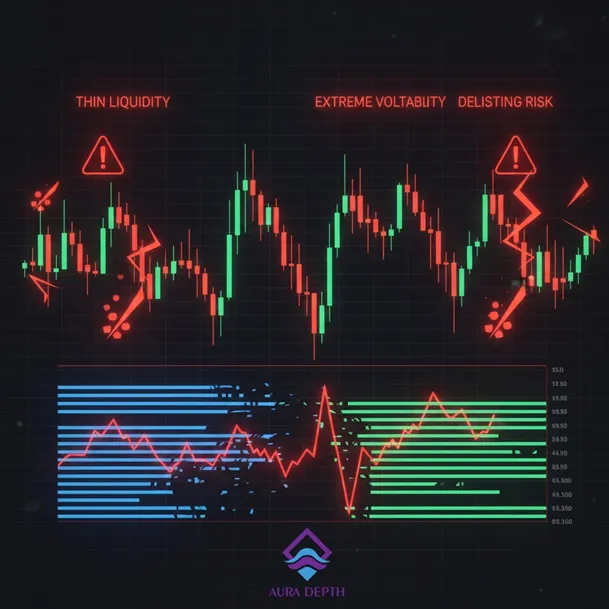

- Increased volatility and rapid price crashes

Most delistings happen not because of price decline — but because the order book becomes dangerously thin.

What Causes Liquidity Problems?

Even fundamentally strong projects often lose control of their order book because of:

- Low trading volume during inactive market cycles

- Automated bots consuming liquidity on both sides

- Lack of coordinated liquidity strategies across CEX/DEX pairs

- Poor communication between tech teams and exchange API requirements

- Fragmented liquidity due to multi-chain expansion

These hidden issues accumulate until the exchange sends the dreaded email: "Your project is required to improve market depth within the next 30 days."

How Professional Market Makers Prevent Delisting

This is where an experienced market-making team becomes essential — not just for placing orders, but for creating a full liquidity architecture. A professional market-making operation includes:

1. Smart Order Book Engineering

Designing balanced spreads, stable buy/sell walls, and multi-layer depth that simulates natural trading flow.

2. Liquidity Risk Assessment

Identifying leaks, arbitrage risks, and vulnerable areas where capital drains unexpectedly.

3. Technical Integration & API Optimization

Many liquidity problems come from outdated or misconfigured APIs. Fixing technical layers can reduce unnecessary slippage by up to 70%.

4. Multi-Exchange Liquidity Synchronization

Ensuring that price and volume remain consistent across exchanges so traders cannot exploit mismatched prices.

5. Market Sentiment Alignment

Liquidity alone is not enough — token communities must feel active and alive. A good strategy pairs liquidity with communication, branding, and social updates.

What Happens If You Ignore Market Depth?

- Continuous price manipulation by small traders

- Loss of investor confidence

- Difficulty securing new exchange listings

- Reduced partnership opportunities

- Declining credibility with institutional partners

Real Lessons From the Field (Auradept Experience)

In the past two years, the Auradept team has helped multiple projects recover from:

- Failed liquidity structure after listing

- Volatility caused by shallow order books

- Exchange warnings due to poor depth

- API malfunction causing inconsistent liquidity

- Fragmented liquidity across markets

One example: A project on MEXC repeatedly failed to maintain the 2% depth requirement because every liquidity injection was quickly consumed. After restructuring their order book and optimizing APIs, the project passed the exchange audit flawlessly and restored confidence.

Final Thoughts

Market depth is not just a technical obligation — it's a strategic shield that protects a token’s long-term viability. Projects that invest early in professional market making build trust, survive volatility, attract real traders, and avoid delisting.

Suggested References

- Binance Market Maker Program – Official Documentation

- MEXC Liquidity Requirements & Depth Standards

- KuCoin Order Book Structure Guidelines

- Polygon Developer Docs (Cross-chain APIs)

- CoinMarketCap Liquidity Score Methodology