The Critical Role of Market Makers in Token Stability: Why Every Web3 Project Needs a Liquidity Strategy

In the fast-moving world of digital assets, most founders understand how important it is to build a strong product, an engaged community, and a clear roadmap. Yet one essential element is often underestimated — market making and liquidity strategy. Without it, even promising projects with real utility struggle to survive on exchanges, losing the confidence of traders before they get the chance to grow.

This article breaks down why liquidity engineering matters, how market makers protect your token, and what mistakes founders should avoid when preparing for listing and long-term stability.

1. Why Liquidity Matters More Than You Think

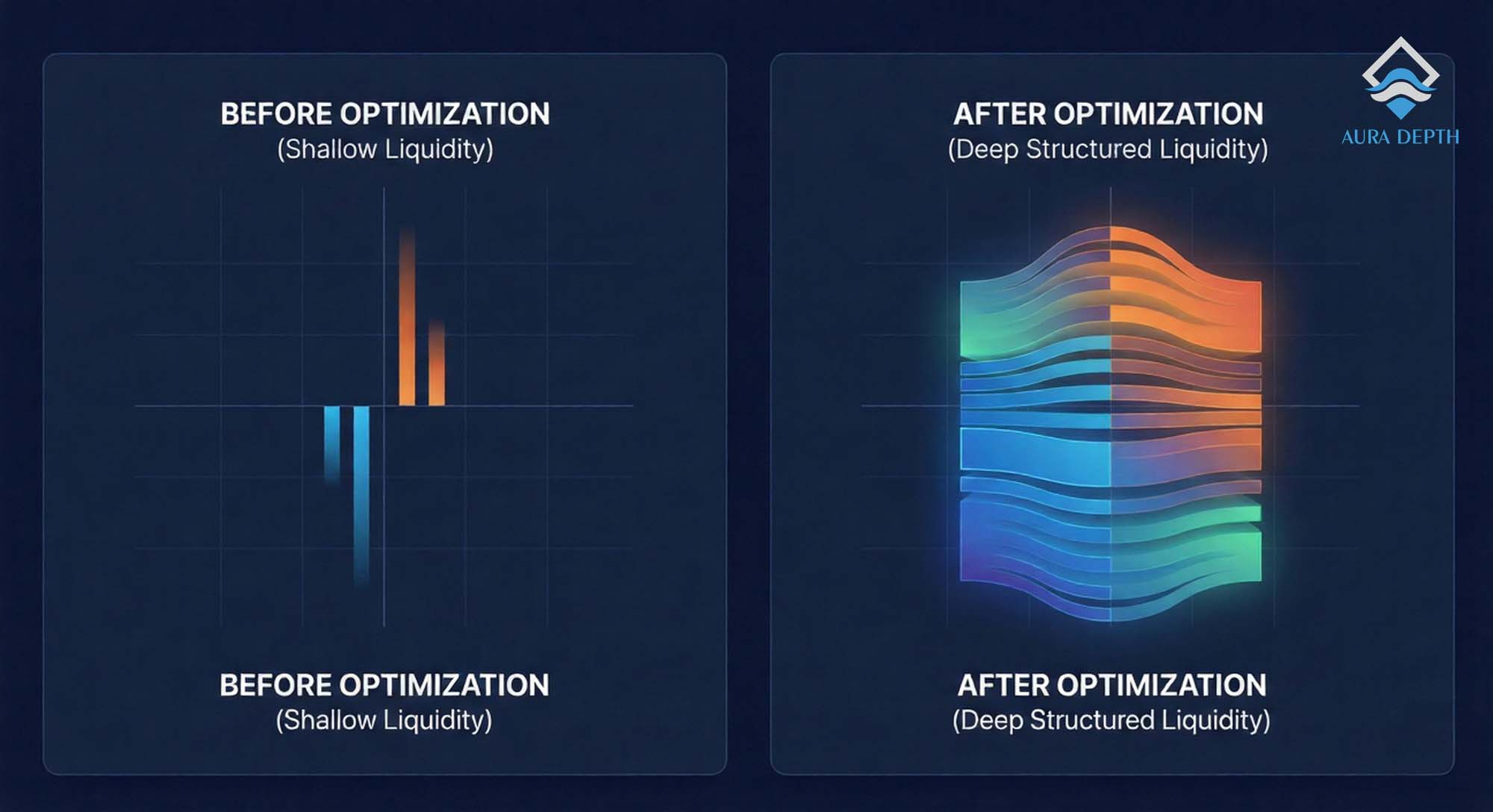

Liquidity isn’t just about having buy and sell orders on a chart — it’s about creating a trading environment that feels healthy, attractive, and safe.

When liquidity is insufficient:

- Price volatility becomes extreme

- Charts look unnatural or “dead”

- Traders avoid entering positions

- Exchanges flag the project for low performance

- Market confidence fades quickly

A well-executed market-making strategy solves all of these issues.

2. The Hidden Challenges Projects Face After Listing

Listing a token is not the end of the journey — it’s the beginning of a new pressure zone:

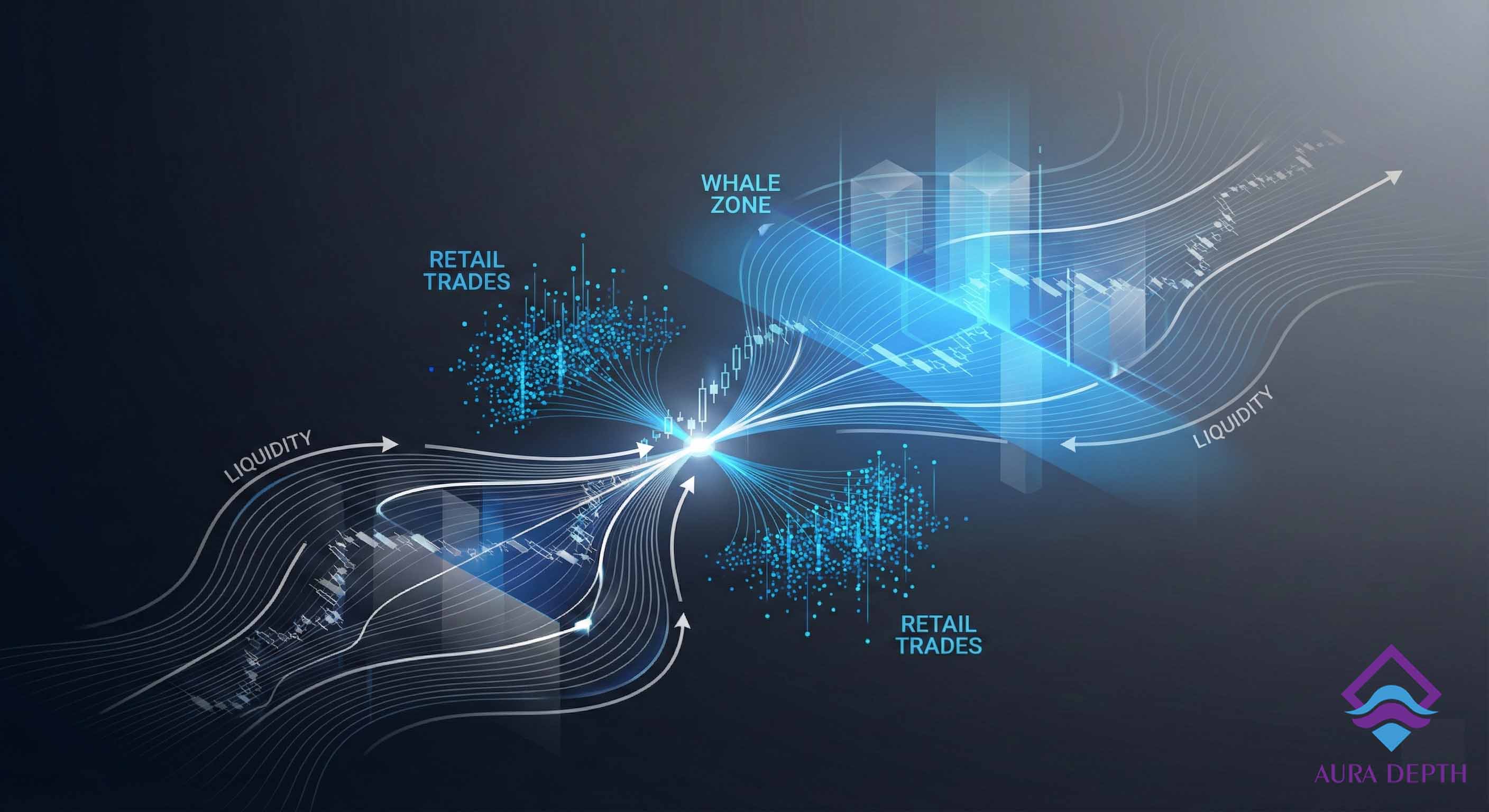

- Exchanges often require strict liquidity and order-book depth standards

- A thin order book leads to price manipulation by traders

- Sudden buy/sell pressure causes massive spikes

- Projects may accidentally lose tokens through inefficient liquidity operations

- Manual interventions lead to human errors and emotional decision-making

Most founders underestimate these challenges until they hit a critical point.

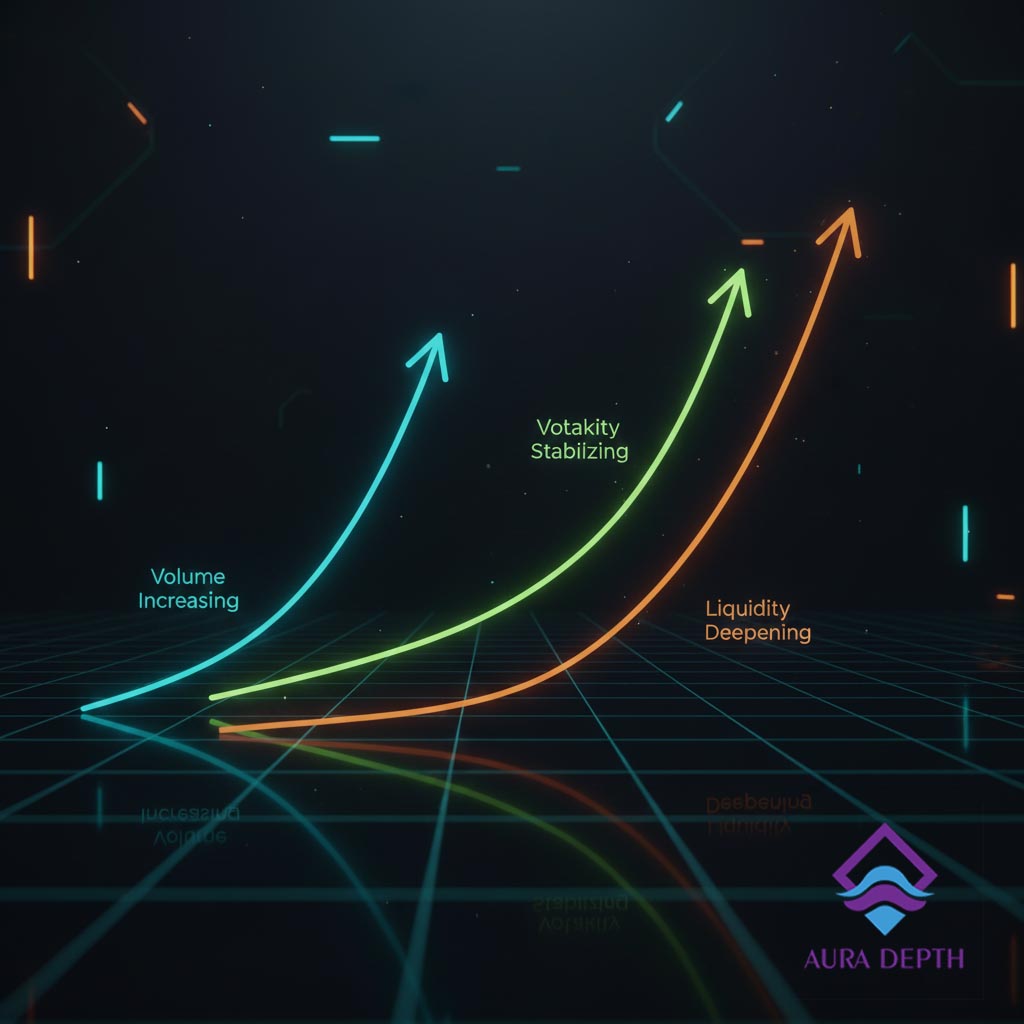

3. How Professional Market Makers Stabilize a Token

A professional market-making team does more than just place orders. They design a long-term economic environment for your token.

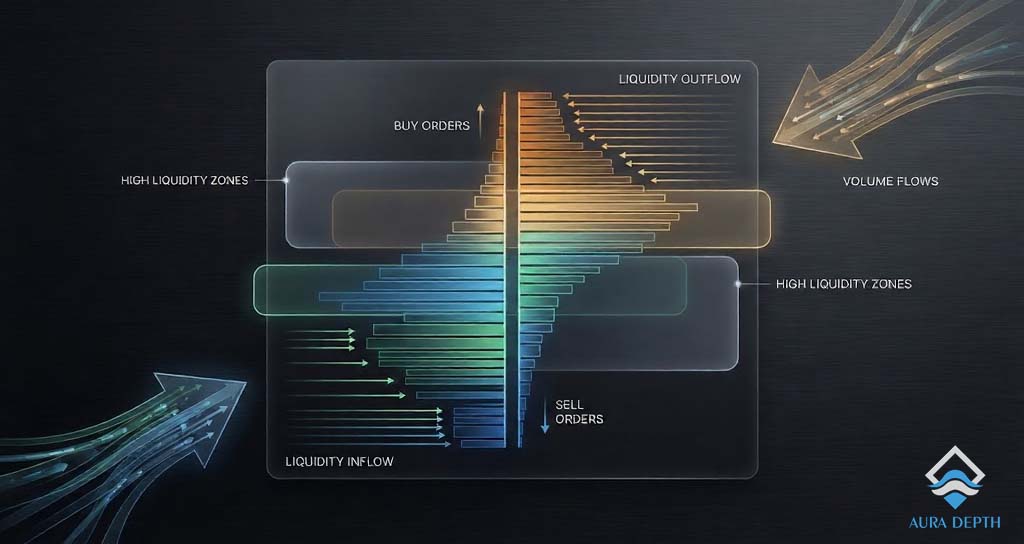

- Smart liquidity distribution across exchange depth levels

- Controlled volatility, preventing aggressive price swings

- High-volume simulation to attract real traders

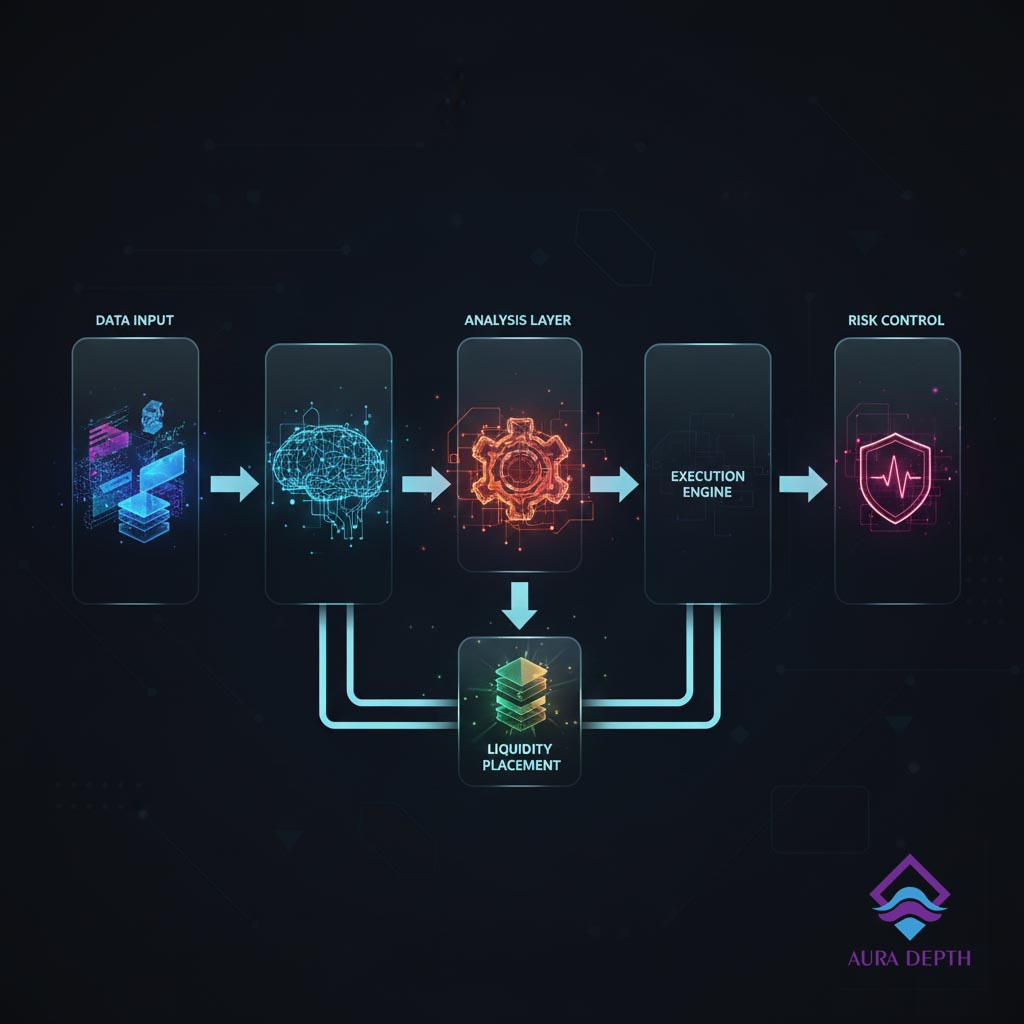

- Algorithmic protection systems to prevent losses

- API-based liquidity engines for consistency

- Real-time risk management

This leads to charts that look organic, believable, and trader-friendly.

4. The Biggest Mistakes Founders Make

Even strong teams often fall into one of these traps:

- Mistake 1 — Assuming liquidity will come naturally: It won’t. Traders only enter markets that already look active.

- Mistake 2 — Ignoring exchange requirements: Each exchange has unique standards for order-book spreads, 2% depth, and API structure. Failure here often leads to delistings.

- Mistake 3 — Letting inexperienced team members manage liquidity: One wrong order can damage the chart for months.

- Mistake 4 — Overreacting to price movements: Emotional decisions kill token stability faster than any mistake.

5. What a Complete Liquidity Strategy Should Include

- Liquidity mapping and modeling

- Automated trading bots

- Spread and depth balancing

- Execution safety layers

- Cross-exchange monitoring

- Volume stimulation programs

- Risk-adjusted volatility control

6. Case Studies: Real Challenges, Real Solutions

Different projects bring different liquidity problems — and each one requires a unique solution.

- A Dubai-based project combined social-media strategy with market making → 165% growth in 5 months.

- Another project passed MXC depth requirements after API restructuring.

- A third project needed a full token deployment and Polygon integration.

7. Why Choosing the Right Partner Matters

Market making is not just numbers and bots. It is about protecting your vision, your traders, and the long-term health of your token.

At Auradept, we have seen dozens of projects struggle with the same issues: unstable charts, insufficient depth, weak communication, and inefficient liquidity burns.

Conclusion

In Web3, perception shapes reality. A token with healthy liquidity, stable movement, and active order books attracts traders, investors, and long-term supporters.

A token without these elements loses trust — no matter how strong the product is behind it. Market making is not optional. It is the backbone of token performance. If you're facing similar challenges or preparing for exchange listing, the Auradept team has deep experience solving exactly these problems — from liquidity modeling to exchange compliance and API risk protection.