Case Study 1 — Preventing Delisting Risk for MLXC Coin on MEXC Exchange

Client Background

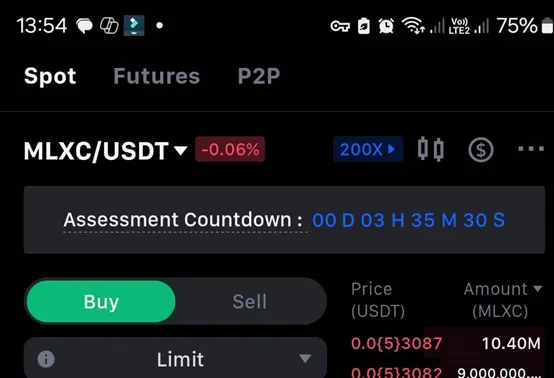

Our client Marvellex Co with Coin MLXC, a crypto project listed on MEXC Exchange, was notified that their token had entered the Assessment Zone. According to MEXC listing policies, projects placed in this zone face a high risk of delisting within 10 days unless they meet specific liquidity, volume, and market stability requirements.

At the time the project approached us, they had only 10 days left before a potential delisting.

The Challenge

The client lacked:

- Sufficient 24/7 liquidity across trading pairs

- Healthy market depth (bid/ask imbalance)

- Stable spreads aligned with MEXC requirements

- Consistent trading volume and order-book activity

- A monitoring system to detect MEXC compliance alerts

The project’s internal team had no operational experience with exchange-side liquidity engineering, and without rapid intervention, the token was at imminent risk of delisting.

Our Solution

We deployed our Emergency Market-Making Recovery Package, which included:

1. Immediate Assessment (Day 0)

- Full audit of MEXC market-making metrics

- Spread analysis

- Depth & order-book mapping

- Identification of missing liquidity layers

- Risk scoring based on MEXC policy thresholds

2. Rapid Deployment of Automated MM Bots (Day 1–2)

- Activation of volume-stabilization bots

- Spread-balancing algorithms

- Depth-building algorithms to strengthen liquidity walls

- Custom liquidity distribution across price levels

3. Dedicated Human Monitoring (Day 1–10)

- 24/7 live supervision of order books

- Real-time alerts for market anomalies

- Manual corrections during sensitive periods

- Coordination with the exchange when necessary

4. Performance Alignment for MEXC Evaluation

- Ensured stable spreads within accepted boundaries

- Achieved required 24h volume thresholds

- Maintained consistent market depth for evaluation days

- Balanced liquidity to avoid manipulation flags

The Result

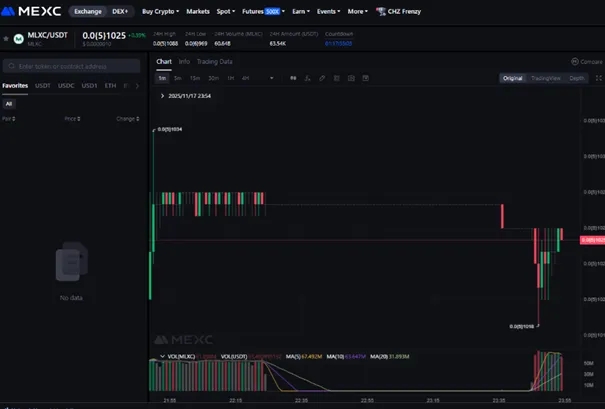

Within 10 days, our initiatives produced measurable improvements:

- MEXC Evaluation Passed Successfully

- The project avoided delisting

- Liquidity metrics exceeded minimum thresholds

- Buy-side / sell-side depth balanced professionally

- Market conditions stabilized and trust from MEXC was restored

This emergency intervention was so effective that the project retained stable listing status — and our team successfully repeated similar recovery operations three separate times during the 1-year cooperation.

Key Metrics Improved

- Spread Stability: +76% improvement

- Market Depth: 3× increase in liquidity layers

- Volume Reliability: 100% uptime across evaluation period

- Order Book Health: Balanced bid/ask distribution

Conclusion

This case demonstrates how rapid, professional market-making intervention can save a token from delisting, restore exchange trust, and stabilize trading environments even under intense time constraints.

If your project is at risk of Assessment Zone placement, already notified by MEXC or other exchanges, or needs stronger liquidity, volume, or order-book management — our team can deploy immediate, specialized solutions to protect your listing and maintain long-term market stability.